Strength in Numbers

According to the recently released Nesta report on the UK Alternative Finance Industry for 2015, the market grew to £3.2 Billion last year. With £2.2 Billion either being lent to or invested in businesses, and the biggest slice of that (£700m) being used for property.

This is an over representation of the sector which leads you to think that there are additional characteristics of property that makes it particularly suited to alternative finance.

There are two main ways for businesses to tap into these alternative sources of money, either as a loan – known as P2P Lending – or as an equity investment more commonly known as equity crowdfunding. Both are increasing in popularity with both investors and property professionals, so it’s worth considering why that might be, and how they differ.

So let’s look at P2P lending for property first. According to the report, £609m was lent for this purpose. That’s more than 20 per cent of the entire market and as much as was lent to individuals last year. There’s no doubt that the size of each transaction will be much higher than personal lending and so that accounts for some of the numbers, but there are some other characteristics, specific to property that are at play here.

As a nation we love property as an asset class. It’s something we can relate to and understand and typically it is the first significant asset we focus on owning ourselves before exploring stocks and shares, commodities or currencies. Yes it can go up and down in value, but, over the longer term, we trust it as a source of guaranteed security.

From a lending perspective, as long as you lend on a low enough loan-to-value, and as long as you’re not lending for too long, you feel pretty sure you will get your money back, forcing a sale if you have to. That’s why the Banks love mortgage business so much, it’s a relatively safe bet.

There are platforms for Buy-to-let mortgages like, bridging loans and development finance, but most of the time the lending will include a first or second charge against the property, so from a lenders point of view, in exchange for a 10 per cent return it’s worth the risk.

Equity crowdfunding however, is slightly different. It grew by 295 per cent last year to a total of £332 million – £87m of which was in property – which is more than the total of equity investments in 2014. So that leaves £245m invested in start-ups and growing businesses – about 15 per cent of the total seed and venture stage equity investments. If property crowdfunding can achieve the same share of the property investment market, it in itself will be a multi-billion segment.

Its predicted that this is exactly what will happen because, as an equity investment, property offers investors so much more than start-up equity, and appeals to a much wider audience of HNW and sophisticated investors as well as to businesses. Whilst they are both investments backing the skill and ability of the people seeking funding, property investment, unlike the start-up, is investment in a real, tangible asset that can be independently valued by a RICS surveyor.

On top of this, start-up equity is an open-ended investment. Crowdcube, which has been going for 5 years has only just had its second exit. Most property crowdfunding platforms work to fixed terms and some also allow you to sell your shares during that term.

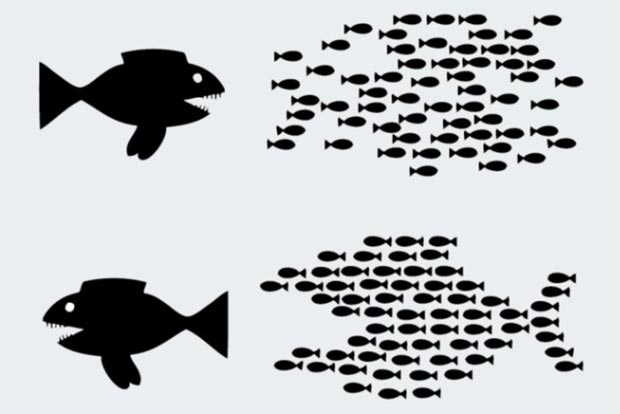

Then there is the issue of returns. Effective start-up investment through crowdfunding relies on investing in multiple businesses, knowing that many will fail, but hoping that you’re backing the next Uber. Whilst diversifying your investment in property is also a good idea, investors should not plan for complete failures, some might not meet their projected returns whilst others will do much better than expected.

Finally there is the issue of dividends. With start-up crowdfunding you don’t expect to receive a dividend for many years, indeed you’d want the profits to be reinvested for growth – whereas with property crowdfunding you know from the outset what the dividend is projected to be, assuming all goes well. These typically project total returns of between 10 per cent and 25 per cent per annum. depending on the type of investment.

These differences, along with our familiarity and comfort with property will, in opinion, mean that next year’s Nesta report will show a very different picture. A glance across the water to the US shows what might just happen. In the last three years, the top 3 US.

property platforms raised over $3Billion between them and none of them existed 5 years ago. Only time will tell whether the UK follows suit.

Other articles you might like …